How is the price for a repair or painting created?

We prepare simple but detailed estimates so that you can understand what criteria are used to determine the price. Subsequent invoices, when work is performed, will always be the same as the original estimate, unless changes have been mutually agreed upon. All insurance companies accept our market-compliant type of estimates.

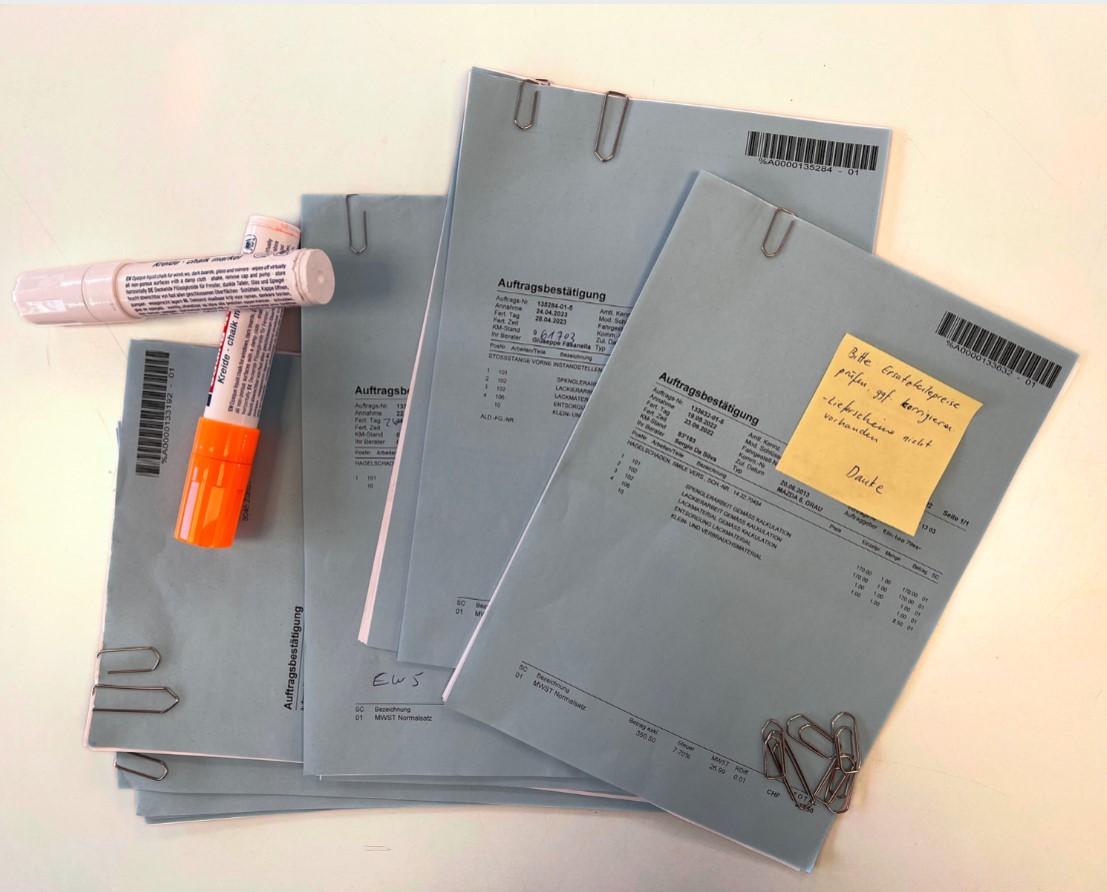

Example cost estimate

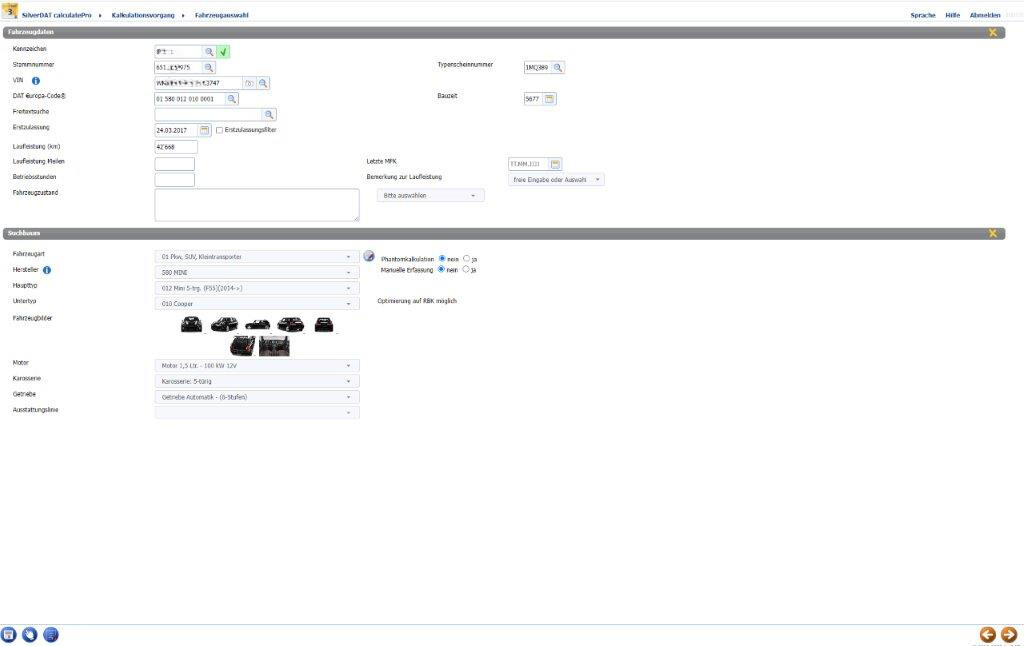

In order to avoid mistakes, but also to be able to show correct prices for our work and the required material, we use the SilverDAT calculation software, which allows us to calculate the price of a repair and a paint job accurately and neutrally. Calculation systems such as SilverDAT software are absolutely common in the industry, are considered state-of-the-art and are accepted by all market participants.

How does this software work?

One of our customer service representatives enters the vehicle’s VIN number into the program to get the important information about the vehicle, such as the vehicle options, to get the correct prices for the parts needed, and the correct amount of time for each job. Then he selects the damaged areas and decides on the repair methods.

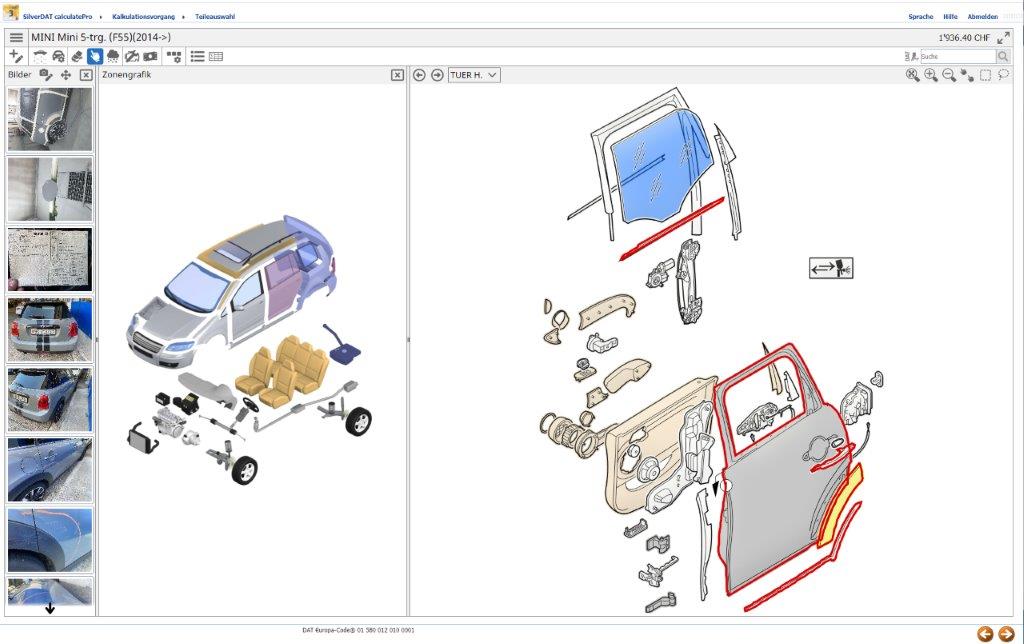

To illustrate this step for you, let’s take the example of a damaged door:

The door can be either replaced or repaired. The bodybuilder clicks on the door, chooses the repair method (repair or replacement), selects the parts to be painted and the program automatically calculates the time needed for all these steps. After completion, the working time is multiplied by the hourly rate and we get the price for the amount of work. The program automatically calculates the price of the paint material needed for this repair, the spare parts and the small and consumable materials and then the estimate is ready! In the calculation systems, the user can choose between 2 to 3 different paint repair levels, depending on the need and technical requirements.

What does the estimate include?

The cost estimate is different from a simple estimate. The latter is only an approximation of the actual cost of the work to be performed, while the estimate is an accurate calculation of all repair costs to be incurred. There are no surprises, besides, the estimate will be explained to you.

The cost estimate includes:

- the exact description of the work to be performed

- the costs and times for the work effort

- the list and prices of the required spare parts

- the amount of value added tax

- the complete cost of the repair

- the period of validity of the cost estimate

Will my body damage be covered by my insurance?

When asked, “Will my body damage be covered by my insurer?” we are inclined to answer, “It depends on your policy!” Because in the insurance sector depends on the approval and the amount of compensation depends on one essential factor: The contract you have signed! Because it is relevant whether you “Third party liability”, “Partial cover” or “Fully comprehensive”. are insured or whether you are covered by a “Parking Damage Coverage” benefit or not – the assumption of a body damage can be very different as a result.

In the case of liability insurance

A vehicle may be put on the road only if it has at least liability insurance. This covers, roughly speaking, damages that you cause to others. In this case, you can’t expect much from your insurance company for property damage caused by hail, for example.

In the case of partial coverage insurance

By extending the mandatory insurance for your vehicle, you can cover additional cost risks. “Glass breakage”, for example, allows you to be covered for damage to the

glass surfaces

of your car to be compensated. Or additional insurance modules for natural hazards, such as a hailstorm, or even for vandalism damage, can be included here to cover the cost of repairs to the bodywork.

In the case of comprehensive insurance

If you have “comprehensive” insurance, your body damage will be reimbursed without difficulty. However, your policy will most likely include a deductible. Only the additional extension with parking damage coverage is in the majority without deductible. To avoid disputes with your insurance company, we recommend that you report the damage to your insurance company promptly after the event. This is the best way to make sure that your insurer will cover the cost of your body damage.